per capita tax burden by state

The five states with the lowest tax collections per capita are Alabama 3370 Tennessee 3405 Arizona 3472 South Carolina 3522 and Oklahoma 3544. And when you compare that to the per capita taxes in the other states Vermont is the 11 th highest.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State and Local Issues.

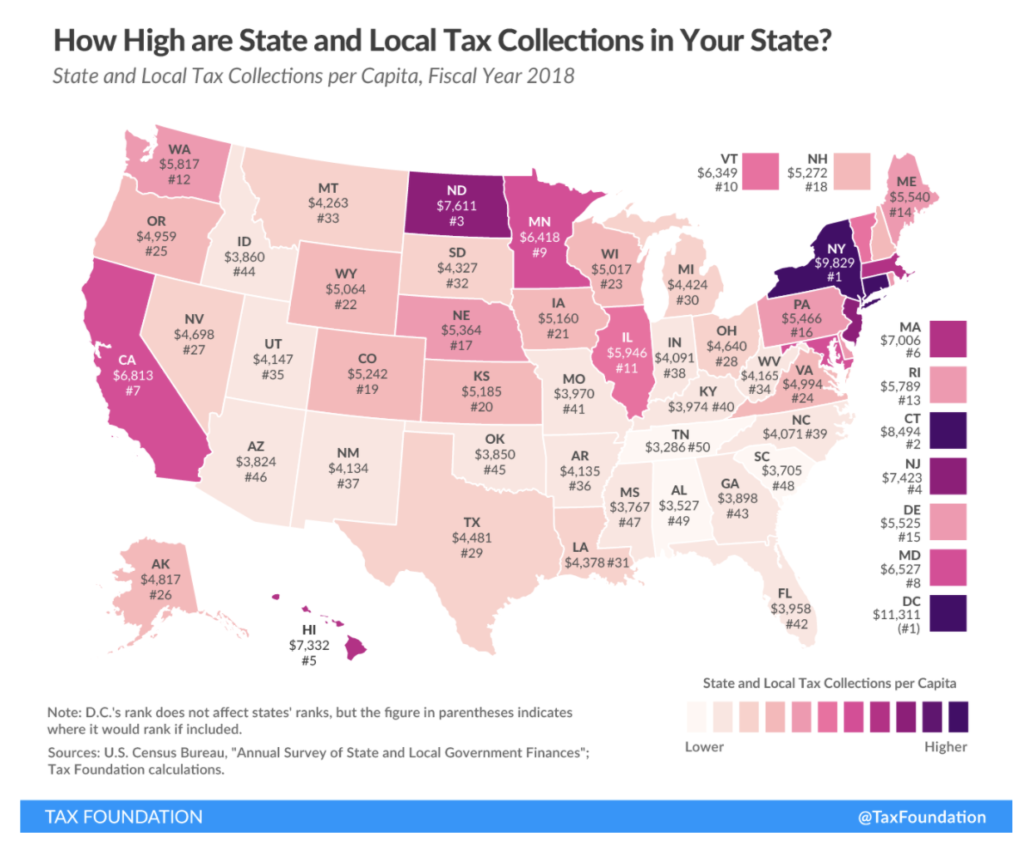

. Counties in per capita income General US 11 replies. New Jersey has the highest property tax rates on owner-occupied homes of 247. The five states with the highest tax collections per capita are New York 9829 Connecticut 8494 North Dakota 7611 New Jersey 7423 and Hawaii 7332.

Washington per capita taxes were below the national average of 3698 for the first time since 1985. This amount is significantly larger than the 582 paid in property taxes per capita in Alabama. Chart 2 portrays the change in per capita state and local taxes since 1970 for Washington and the average for all states.

Hawaii and South Dakota have broad sales tax base s that include many services contributing to those states high collections per capita. Tax Burden State By State. The five states with the lowest tax collections per capita are Alabama 3206 Tennessee 3322 South Carolina 3435 Oklahoma 3458 and Florida 3478.

Heres each state and DC ranked from lowest to highest per-capita 2017 total tax revenue along with per-capita estimates for income sales property and other taxes according to. The five states with the highest tax collections per capita are New York 9073 Connecticut 7638 New Jersey 6978 North Dakota 6665 and Hawaii 6640. Alabama Alaska Arizona Arkansas.

445 KB August 26 2021. State-Local Tax Burdens Calendar Year 2005 Rank State StateLocal taxes as of per capita income US. Tax Burden Per Capita.

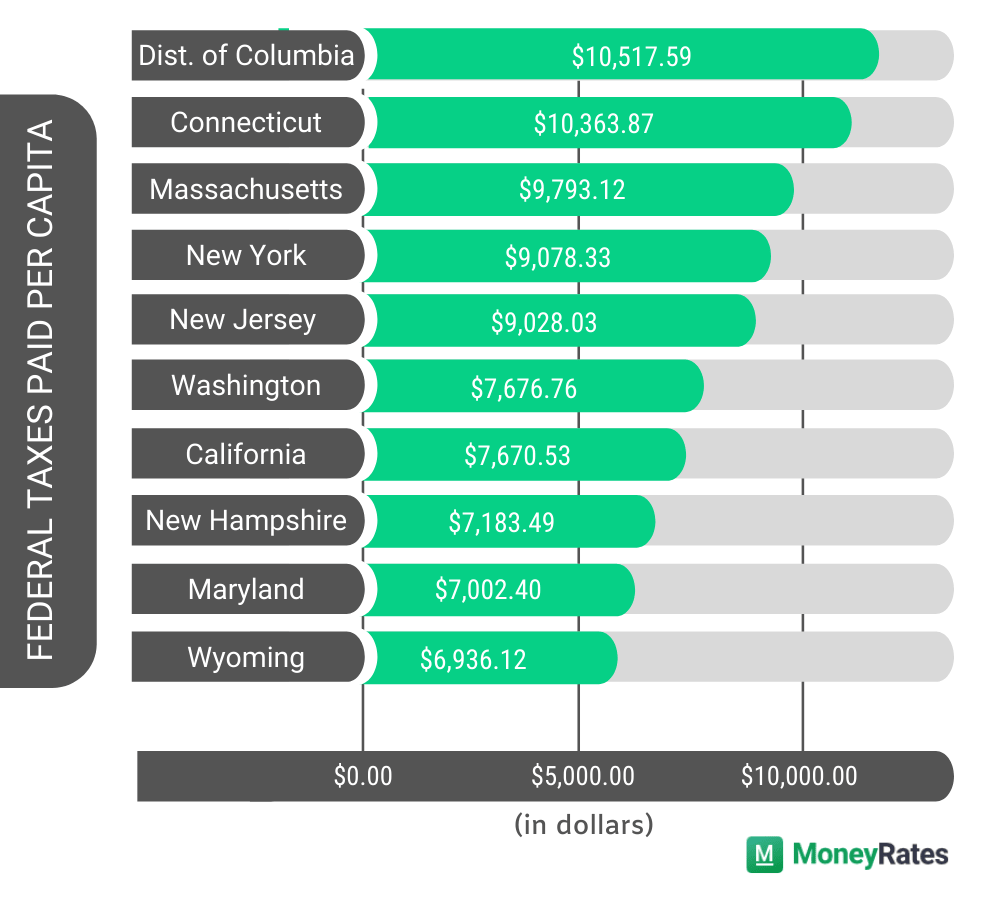

Still residents of DC. The amount of federal taxes paid minus federal spending received per person by state can be found here. State and Local Tax Revenue Per Capita.

87 6 3926 Ark. 48 rows Table 2. See more graphs about.

A per capita tax comparison is far from complete however because differences in the level of. Americans pay about 5000 a year in state and local taxes about 10 of their income. The average resident of a blue state pays 9438 in federal taxes while the average resident of a red state pays 6591.

The five states with the highest tax collections per capita are New York 8957 Connecticut 7220 New Jersey 6709 North Dakota 6630 and Massachusetts 6469. And as the article said if you divide that by the number of people in Vermont you get a per capita tax burden of 4650. Pay the highest property taxes per capita of 3500.

Average on both income-based and per capita based analyses. 211 rows Total taxes thousands Population Per capita State Alabama. 90 13 3893 Alaska 58 1 3605 Ariz.

For Vermont the total was 29 billion. Here are the five states with the biggest per capita tax burden according to their calculations. The tax burden can vary by state ranging from 72 to 138.

In fiscal year FY 2018 the highest state sales tax collections per capita were found in Hawaii 2694 the District of Columbia 2128 Washington 2118 Nevada 1941 Louisiana 1852 and South Dakota 1702. 13371 KB Download dqs_table_79axls. 108 MB Download dqs_table_87xls.

Drug Overdose death rates by state 2015. State-Local Tax Burdens per Capita as a Percentage of Income Fiscal Year 2019 State State-Local Tax Burden as a Share of State Income Rank Total Tax Burden per Capita US. Nebraska lowest West Virginia highest per-capita General US 36 replies FBI study shows which state has the most gangmembers per capita General US 104 replies Tax Burden and Return by state General US 0 replies Top 100 US.

The article cited 2009 Census data the latest available on taxes collected by state and local governments. State and Local General Expenditures Per Capita. State-Local Tax Burdens by State with Detailed Breakdown Calendar Year 2019.

This US destination is among the ones with the worst tax burden by state. Tax Burden State By State. Per 1000 of Income Per capita Idaho total tax burden 8957 3852 National average total tax burden 10126 5384 Western median total tax burden 9210 4687.

Average 1010 1 Maine 1300 2 New York 1200 3 Hawaii 1150 4 Rhode Island 1140 5 Wisconsin 1140 6 Vermont 1110 7 Ohio 1100 8 Nebraska 1090 9 Utah 1090 10 Minnesota 1070 11 Arkansas 1050 12 Connecticut 1050 13 West. The five states with the lowest tax collections per capita are Tennessee 3286 Alabama 3527. Tax Burden as a Percentage of Income.

104 34 4581 Calif. Tax collections of 11311 per capita in the District of Columbia surpass those in any state.

How Is Tax Liability Calculated Common Tax Questions Answered

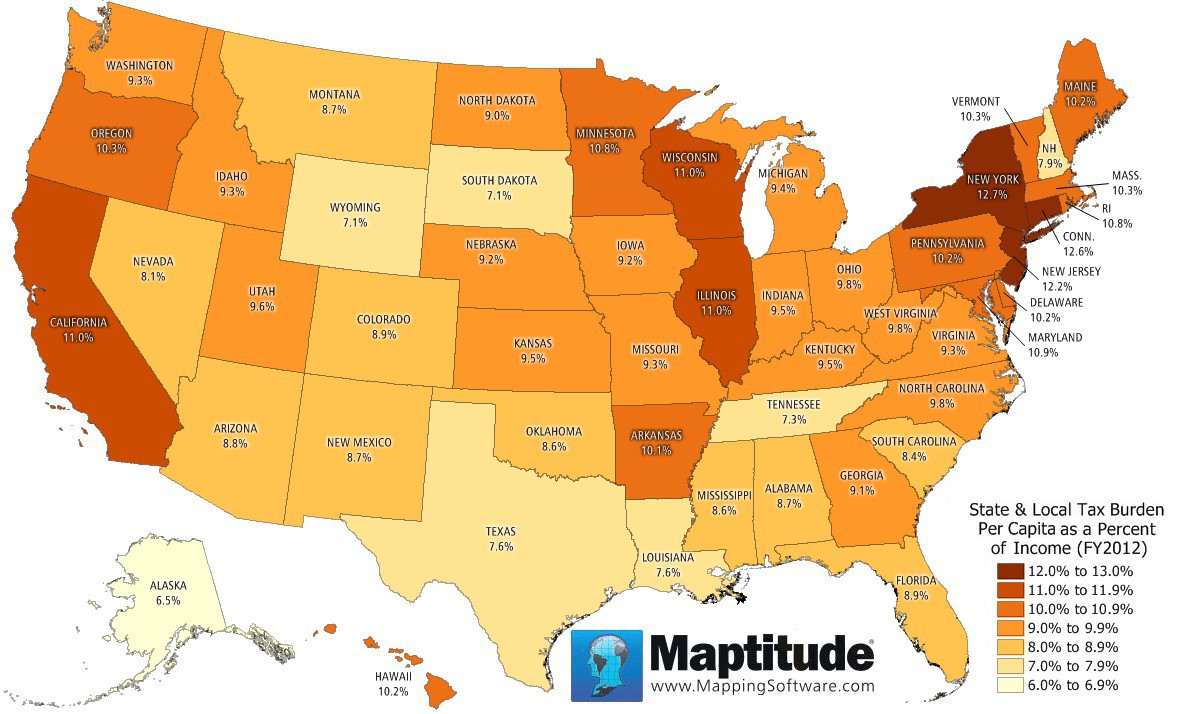

Maptitude Map State Income Tax Burden

State Local Property Tax Collections Per Capita Tax Foundation

Tax Burden Per Capita Other State Austin Chamber Of Commerce

Tax Burden By State In 2022 Balancing Everything

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

How High Are Capital Gains Tax Rates In Your State Capital Gains Tax Capital Gain Finance Jobs

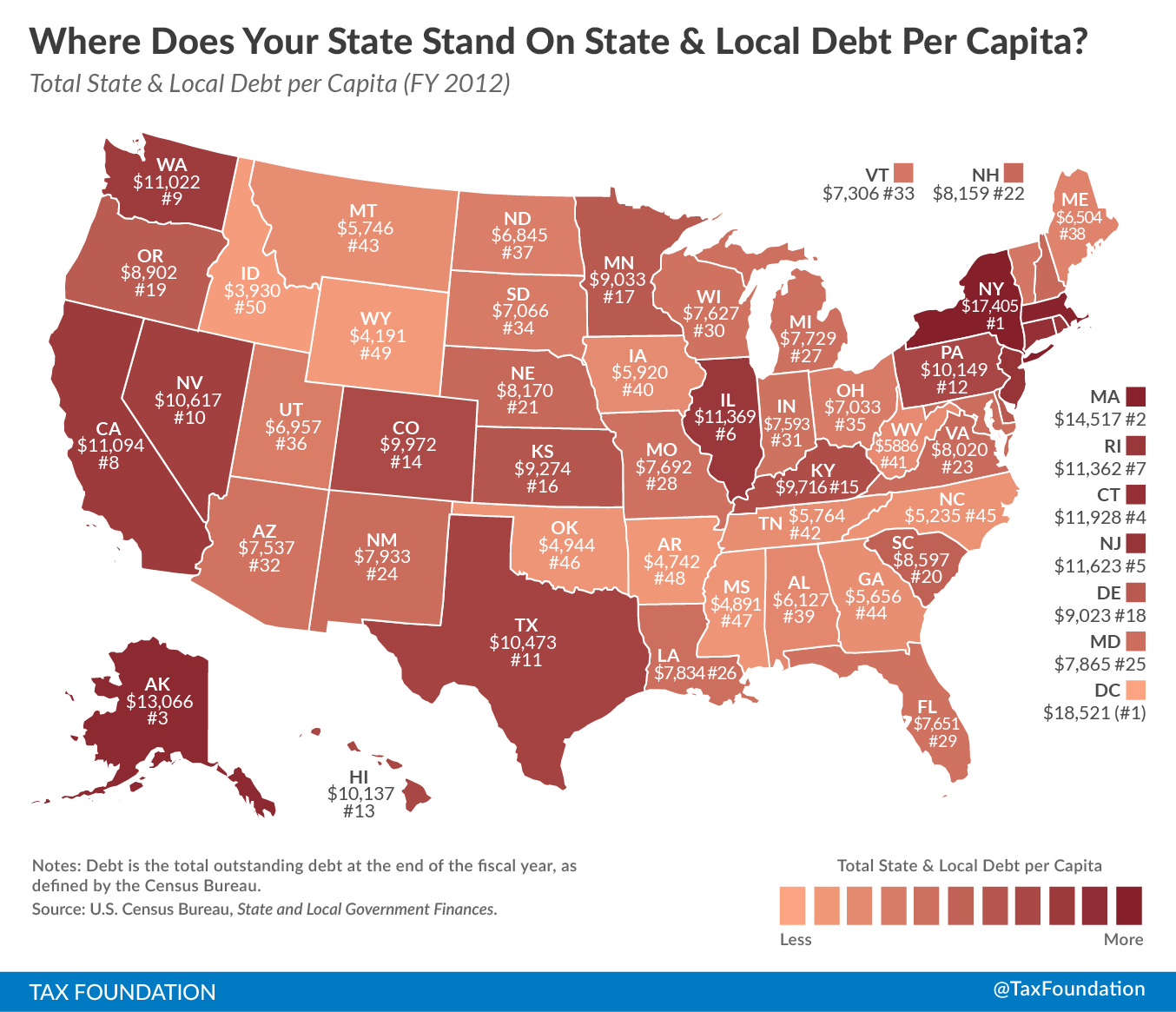

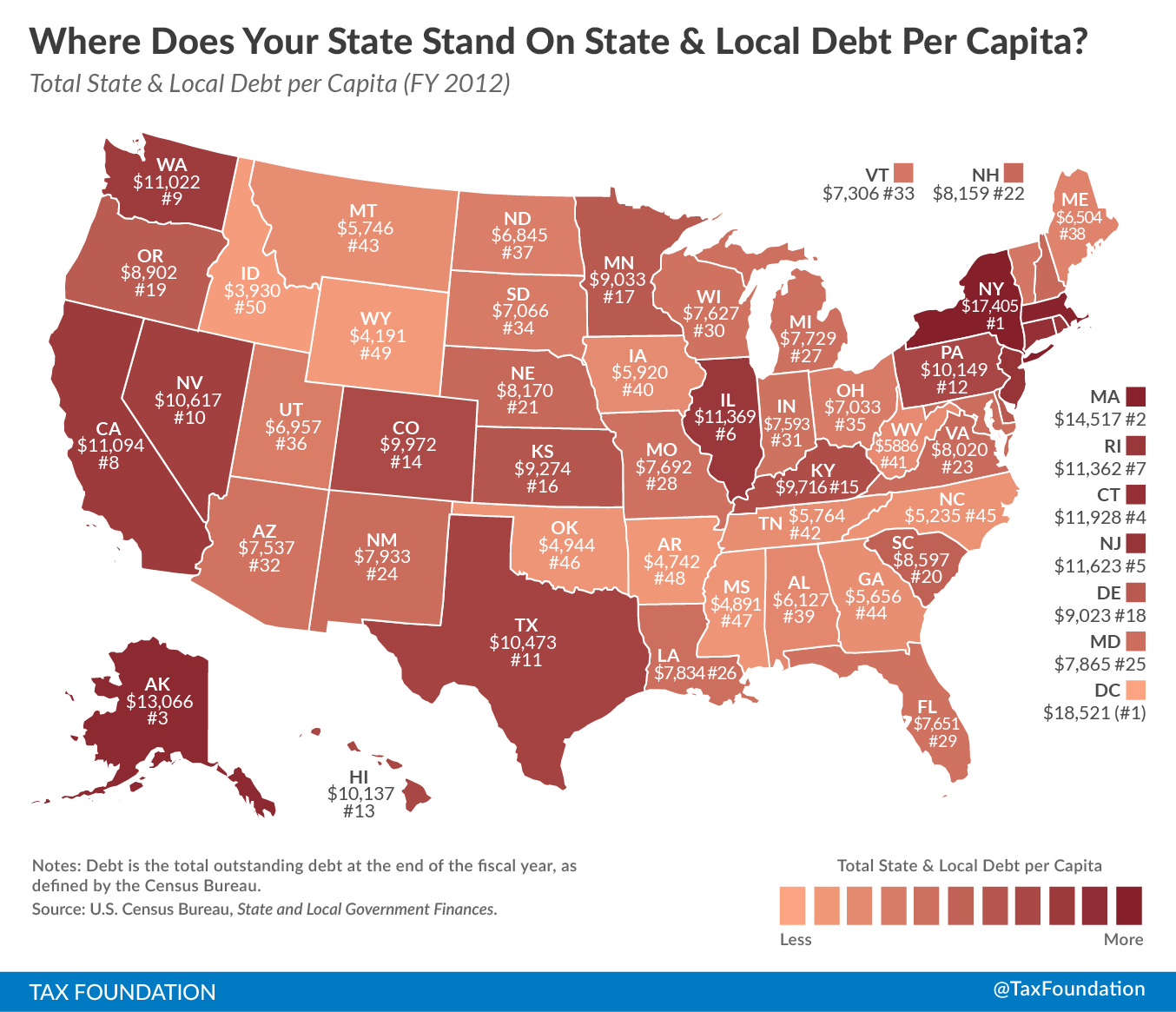

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Mapsontheweb Infographic Map Map Sales Tax

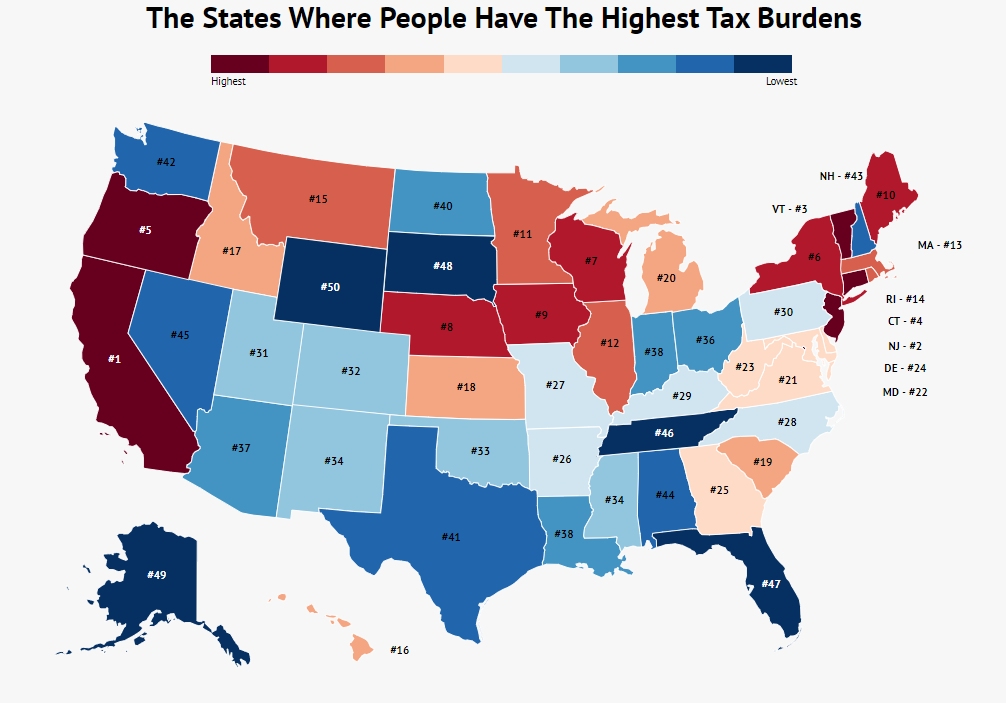

The States Where People Are Burdened With The Highest Taxes Zippia

Using The Tax Structure For State Economic Development Urban Institute

Monday Maps State And Local Tax Burdens Vs State Tax Collections Tax Foundation

Per Capita U S State And Local Tax Revenue 1977 2018 Statista

Minnesota Ranks 9th Highest In State And Local Taxes American Experiment

Which States Pay The Most Federal Taxes Moneyrates

Monday Map State Local Property Tax Collections Per Capita Teaching Government Property Tax Map