how much tax is taken out of my paycheck new jersey

Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. Total income taxes paid.

New Jersey Nj Tax Rate H R Block

Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New.

. Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out. All data was collected on and up. New employers pay 05.

Free for personal use. - New Jersey State Tax. You are able to use our New Jersey State Tax Calculator to calculate your total tax costs in the tax year 202122.

Filing 6500000 of earnings will result in 497250 being taxed for FICA purposes. As a result of COVID-19 causing people to work from home as a matter of public health safety and welfare the Division will temporarily waive the impact of the legal threshold within NJSA. What money gets taken out of my paycheck.

Both employers and employees contribute. The amount withheld must be at least 10 per month in even dollar amounts no cents. Switch to New Jersey salary calculator.

Amount taken out of an average biweekly paycheck. What percentage is taken out of your paycheck for taxes in. For those age 50 or older the limit is 27000 allowing for 6500 in catch-up contributions.

Rates range from 05 to 58 on the first 39800 for 2022. The credit represents the amount of New Jersey Income Tax that you would have paid had the income been earned in New Jersey or the amount of tax actually paid to the. This results in roughly 14250 of your earnings being taxed in total although.

847-676-5150 How Much Federal Tax is Taken Out of my Paycheck Federal Insurance Contributions Act FICA. To use our new jersey salary tax calculator all you have to do. What percentage is taken out of your paycheck for taxes in new jersey.

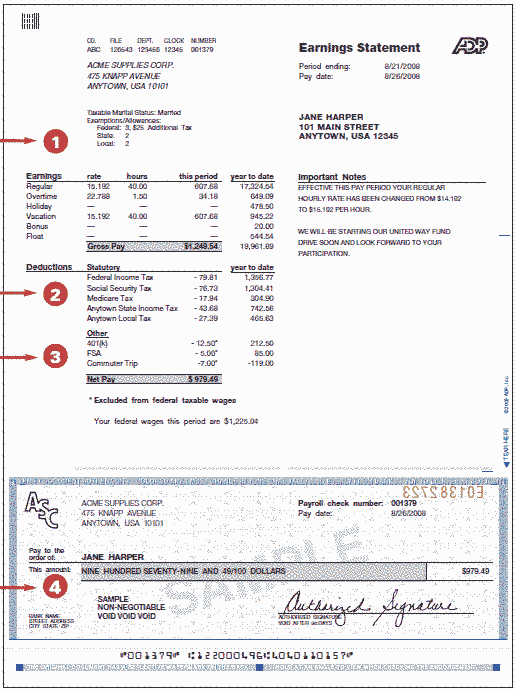

FICA taxes consist of Social. Total annual income - Tax liability All deductions Withholdings Your annual paycheck. New Jersey Salary Paycheck Calculator.

187-19 a which treats the presence of employees working from their homes in New. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and.

New Jersey Hourly Paycheck Calculator. If you rent an apartment or a house you can deduct 18 of your yearly rent to cover paid property taxes. Federal income taxes are also withheld from each of your paychecks.

Its important to note that there are limits to the pre-tax contribution amounts. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period. How Your New Jersey Paycheck Works.

NJ Income Tax - Withholding Information. Your employer will also pay that same amount so that. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020.

Calculates Federal FICA Medicare and withholding taxes for all 50 states. GOBankingRates found the total income taxes paid total tax burden and how much was taken out of a bi-weekly paycheck for each state. This New Jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis.

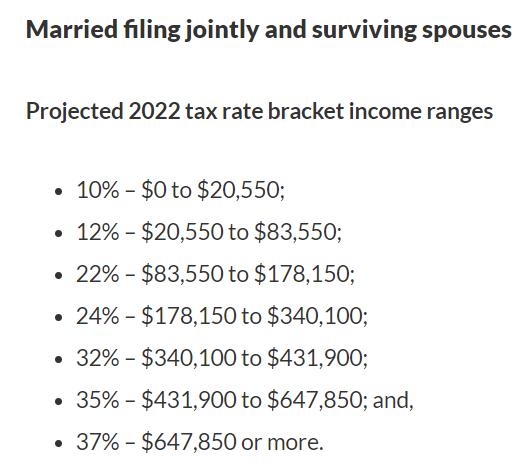

If youre a new employer youll pay a flat rate of 28. New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million. More From GOBankingRates.

Amount taken out of an average biweekly paycheck. Taxable income Tax rate based on filing status Tax liability. Adjusted gross income - Post-tax deductions Exemptions Taxable income.

If you need help deciding whether or not to have New Jersey income tax withheld or how much tax to have withheld you can contact the New Jersey Division of Taxation at 609 292-6400. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Our calculator has been specially developed in order to provide the users of the calculator with not only. A 2020 or later W4 is required for all new employees. New jersey state payroll taxes new jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million.

9am - 1pm CentralPhone. New Jersey has a progressive income tax system in which the brackets are dependent on a taxpayers filing status and income level. If you own your residence 100 of your paid property tax may be deducted up to 10000.

Filing 6500000 of earnings will result in 198950 of your earnings being taxed as state tax calculation based on 2021 New Jersey State Tax Tables. It through your MBOS account by completing a New Jersey W-4P. All other businesses are taxed based on employment experience.

Note that in order to qualify for this rent deduction your rental unit. Though the credit reduces your New Jersey Income Tax you are not necessarily entitled to a dollar-for-dollar credit for the total amount of taxes paid to the other jurisdiction. For 2022 the limit for 401 k plans is 20500.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in New Jersey. Well do the math for youall you need to do is enter the applicable information on salary federal and state. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in New Jersey. Now is the easiest time to switch your payroll service. Your employer will withhold 145 of your wages for Medicare taxes each pay period and 62 in Social Security taxes.

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

Paycheck Calculator Take Home Pay Calculator

I Make 800 A Week How Much Will That Be After Taxes Quora

Is An Employer Allowed To Stop Taking Federal Taxes Out Of My Paycheck So That I Can Take Advantage Of A Tax Credit Quora

Paycheck Calculator Take Home Pay Calculator

Different Types Of Payroll Deductions Gusto

Pay Stub Meaning What It Is And What To Include On A Pay Stub

How To Read Your Paycheck Stub Clearpoint Credit Counseling Cccs Credit Counseling Payroll Template Debt Relief

What Can I Deduct From My Employee S Paycheck Exaktime

We Make A Personalized High Quality Paycheck Stub W Company Logo For You Including Income Taxes Deductions Ytd Totals Credit Card App Paycheck Income Tax

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Here S How Much Money You Take Home From A 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary

Here S How Much Money You Take Home From A 75 000 Salary

Sample Pay Check And Fica Taxes Savings For Cpt Opt Studetns

2022 Federal Payroll Tax Rates Abacus Payroll