will capital gains tax increase in 2021 be retroactive

Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023. On May 28th 2021 the United States Department of the Treasury published the Greenbook for the Biden Administration Budget Plan.

Act Now Estate Tax Planning Under The Biden Administration Union Bank

Treasury Secretary Janet Yellen suggested in remarks before a Senate panel that if Congress were to pass a capital-gains tax hike effective starting in April 2021 that.

. The later in the year that a Democratic tax bill if any is passed the less likely it will have any retroactive effect. Also notable that since it would be retroactive to April 28 2021 it could influence many folks who took gains during the latest crypto surge. This is a total of 1124000 additional tax.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. Equally concerning to the more affluent taxpayers is the possibility that tax increases will be retroactive to the beginning of 2021.

This would be a very unpleasant surprise to households that may have wanted a chance to lock in some gains before any higher tax rates went into effect. Taxing capital gains at ordinary income tax rates would bring the combined top marginal rate in the US. President Joe Biden unveiled a budget proposal Friday calling for a 396 top capital gains tax rate matching previous outlines to help pay for the American Families Plan.

Most likely the actual long-term capital gains tax increase will be agreed to in reconciliation of the infrastructurestimulus bill this coming fall. The later in the year that a. Retroactive Capital Gains Tax Hike On the tax front the biggest surprise in Bidens proposal is that he assumes an increase in the capital gains rate would be retroactive to April 2021.

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was. Top earners may pay up to 434 on long-term capital gains including the 38 Net Investment Income Tax.

AUGUST 11 2021 BYJOE BISHOP-HENCHMAN. This plan was made to be retroactive in order to make it harder for investors to prepare. The 2022 Greenbook indicates that the proposed capital gains tax increase as part of the American.

Proposed Biden Retroactive Capital Gains Tax Could Be Challenged on Constitutional Grounds. The gross tax increase would be reduced on a net basis by increases in tax credits for certain. Having resolved the infrastructure bill Congress now begins debate and consideration of the budget through a reconciliation process since that can be passed with 50 votes bypassing the normal process that subjects.

This leads to the question of whether gains from transactions completed in 2021 but prior to such legislative change could be subject to a higher. Those sales of course would result in a windfall of capital-gains tax revenue for the federal government at ironically only to the naive the pre-increase rates. The Treasury Greenbook is a summary explanation of an Administrations Revenue Proposals for the upcoming fiscal year and beyond.

Up until now the tax rate on capital gain has been zero 15 or 20 depending on your income. Details Analysis of Tax Provisions in the Budget Reconciliation Bill Dec. House Build Back Better Act.

The capital gains tax. Biden unveiled a budget proposal Friday June 4 2021 that called for a 396 top capital gains tax rate to help pay for the American Families Plan. JD CPA PFS.

My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. 2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe. This would mean actions taken now which under the current tax.

The 2022 Greenbook indicates that the proposed capital gains tax increase as part of the American Families Plan would be retroactive to late April 2021 the date of the Plans announcement. Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube. In some cases you add the 38 Obamacare tax but at worst your total tax bill is 238.

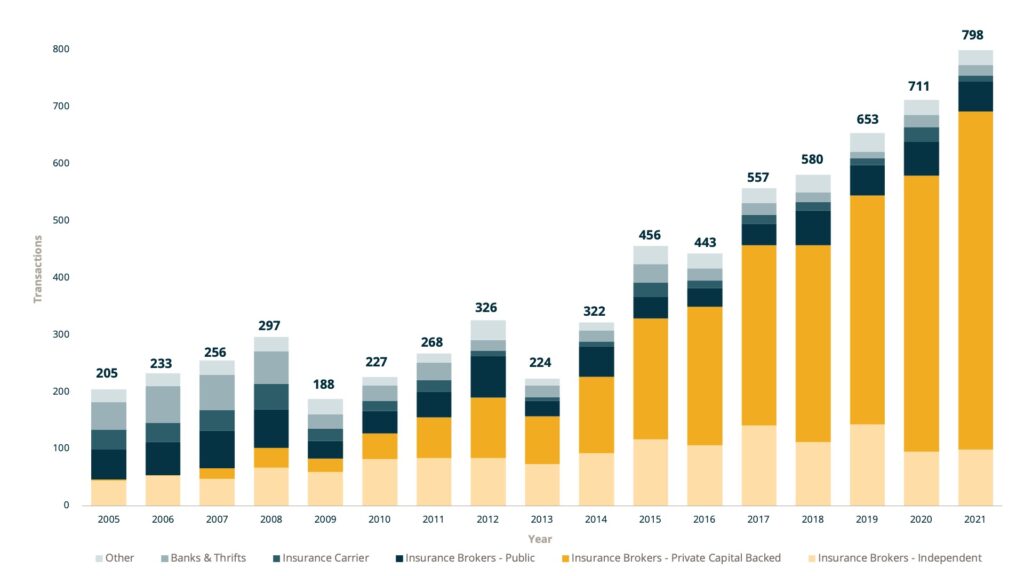

Is This The Greatest Industry In The World Marshberry

Supplement To J K Lasser S 1 001 Deductions And Tax Breaks 2022

Should Biden S Tax Plan Lead To Investment Sell Offs Smartasset

Estate Planning Under Biden Administration Stay Ahead Of Possible Tax Changes Boston Business Journal

Why This Entrepreneur Wants You To Be A Millionaire

Proposed Boost In Capital Gains Tax And Curtailment Of 1031 Like Kind Exchanges Could Shift Real E Marks Paneth

North Carolina Providing Broad Based Tax Relief Grant Thornton

State Corporate Income Tax Rates And Brackets Tax Foundation

2021 Tax Update Comparing And Preparing For The Latest Tax Proposals Key Private Bank

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

Growth Profits And Wealth Blog Travis Raml Cpa Associates Llc

State And Local Tax Salt Deduction Salt Deduction Taxedu

Tax Alert Build Back Better Plan Elliott Davis

Should Biden S Tax Plan Lead To Investment Sell Offs Smartasset

What Is Form 4972 Tax On Lump Sum Distributions Turbotax Tax Tips Videos

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

How Super Wealthy Americans Fare Under Biden S New Tax Plan Advisorhub

Should Biden S Tax Plan Lead To Investment Sell Offs Smartasset

Billionaire Tax Hits Critics As Biden Pushes For Budget Deal Ap News